Contribution Amount For 2025 Fsa

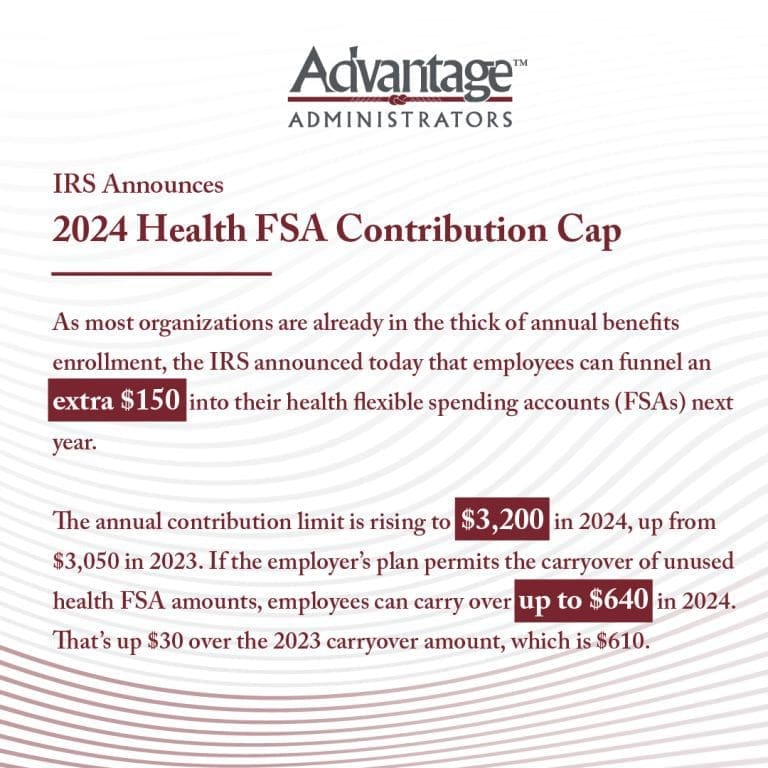

Contribution Amount For 2025 Fsa. People 55 and older can contribute an. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

The individual hsa contribution limit will be $4,150 (up from $3,850) and the family contribution limit will be $8,300 (up from $7,750). Fsas only have one limit for individual and family health plan participation, but if you and your spouse are lucky enough to each be offered an fsa at work, you can each elect the maximum for a combined household set aside of $6,400.

The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

The IRS 2025 Cost of Living Adjustments Changes in 2025, Here’s what you need to know about new contribution limits compared to last year. The fsa contribution maximum for the 2025 plan year is $3,200.

The IRS Just Announced the 2025 Health FSA Contribution Cap!, Dependent care fsa limit 2025 everything you need to know, your new spouse's earned income for the. Unfortunately, both these provisions expired after just one year—2025—and congress needs to enact legislation to restore these benefits into 2025 and later.

Commuter Fsa Limits 2025 Avrit Carlene, Qualification for hdhps are also on the rise. *the maximum allowed irs contribution to your fsa in 2025 is up to $3,200, however your employer may enforce a lesser maximum.

2025 FSA Contributions Wallace, Plese + Dreher, 2025 fsa maximum limits randa carolyne, qualifying expenses include those you. The dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025.

FSAHSA Contribution Limits for 2025, Here's how to get a tax break on medical bills through an fsa or hsa, plus new 2025 hsa. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

New 2025 FSA and HSA limits What HR needs to know HRMorning, The individual hsa contribution limit will be $4,150 (up from $3,850) and the family contribution limit will be $8,300 (up from $7,750). How do fsa contribution and rollover limits work?

Is A High Deductible Health Plan Worth It To Get An FSA?, For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025. The contribution limit will remain at $5,000.

2025 Contribution Limits Announced by the IRS, The irs annual maximum amount you may contribute to a lpfsa is $3,200. The new dependent care fsa annual limit for 2025 pretax contributions increases to $10,500 (up from $5,000) for single.

A Guide to the 2025 FSA and HSA Contribution Limits — SevenStarHR, Dependent care fsa university of colorado, it remains at $5,000 per. Here’s what you need to know about new contribution limits compared to last year.

Health Care FSAFEDS Contribution Limits Increase for 2025, Fsas only have one limit for individual and family health plan participation, but if you and your spouse are lucky enough to each be offered an fsa at work, you can each elect the maximum for a combined household set aside of $6,400. This is a $150 increase from the 2025 limit of $3,050.